Top 5 Employer Benefits Agencies in Florida, Texas, California, Virginia, North Carolina & South Carolina

As businesses across the South and West continue to compete for top talent, one factor consistently shapes employee satisfaction and retention: benefits. From health coverage and wellness programs to tax-efficient reimbursement strategies, today’s employers need agencies that can balance cost control with innovation.

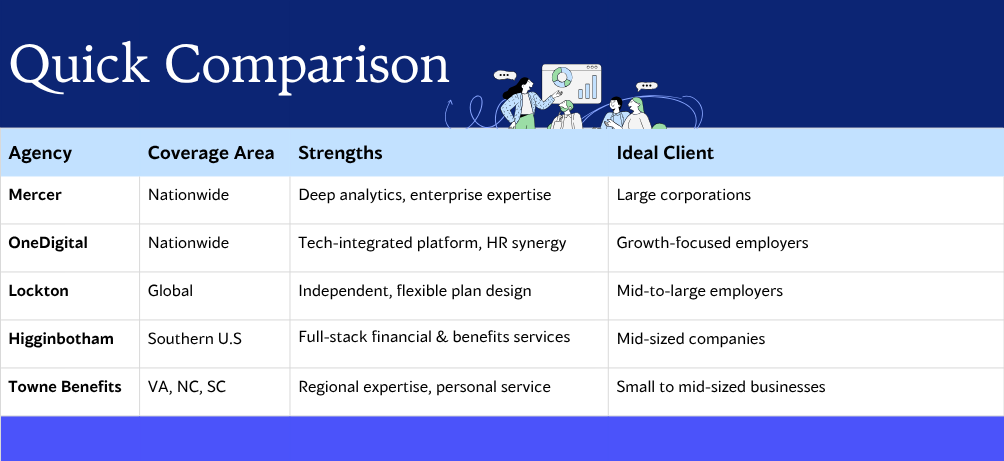

Here are the Top 5 Employer Benefits Agencies serving Florida, Texas, California, Virginia, North Carolina, and South Carolina — plus how Abbott Family Insurance is transforming the space with technology-driven and tax-advantaged solutions.

1. Mercer

Locations: Nationwide, including strong offices in California, Texas, Florida, and Virginia

Website: mercer.com

Mercer is a global powerhouse in employee benefits, known for its analytics-driven approach and vast carrier network. They help large employers design and optimize total rewards programs, manage compliance, and control healthcare costs at scale.

Why they stand out: Their global resources, data science capabilities, and enterprise-level strategy make them one of the most trusted names in the industry.

2. OneDigital

Locations: Offices across all six featured states

Website: onedigital.com

OneDigital merges benefits, HR, and technology into one seamless platform. Their focus on digital transformation simplifies plan administration while keeping employees engaged through modern, mobile-friendly tools.

Why they stand out: A technology-forward model that integrates data analytics, cost containment, and benefits communication into one cohesive system.

3. Lockton

Locations: Nationwide; strong in California and Texas

Website: lockton.com

Lockton is the world’s largest privately owned insurance brokerage. Their independence gives them flexibility to design customized benefits plans without carrier restrictions. They’re known for client-first service and robust wellness and voluntary benefit programs.

Why they stand out: Their client-centric structure and global reach allow for personalized solutions supported by large-scale resources.

4. Higginbotham Insurance & Financial Services

Locations: Based in Texas, with 140+ offices nationwide

Website: higginbotham.com

Higginbotham blends traditional brokerage services with financial planning, risk management, and compliance support. Their strength lies in regional relationships and deep carrier expertise throughout the South.

Why they stand out: Their integration of benefits, insurance, and financial services under one roof creates a single, streamlined experience for employers.

5. Towne Benefits

Locations: Virginia, North Carolina, South Carolina

Website: townebenefits.com

Towne Benefits is a regional leader offering health, life, payroll, and compliance support to small and mid-sized businesses. Their “local service, large capabilities” model resonates with employers seeking personal relationships and tailored plans.

Why they stand out: Their local expertise and responsiveness make them a strong choice for regional organizations in the mid-Atlantic.

How Abbott Family Insurance Is Competing — and Redefining the Industry

At Abbott Family Insurance, we’re challenging the traditional brokerage model by combining modern technology, tax-smart programs, and personalized plan design into a single, high-impact solution for employers.

💡 Technology That Simplifies Benefits

Our proprietary platform unifies enrollment, benefits administration, analytics, and compliance — eliminating manual paperwork and improving accuracy. Employers gain full visibility into their benefits performance, in real time.

🧮 Smarter, Tax-Advantaged Plans with SIMRP

Through our Self-Insured Medical Reimbursement Program (SIMRP), we help businesses transform traditional benefits into strategic financial advantages — lowering taxable income while improving access to preventive care and employee wellness.

💬 Designed for Employee Engagement

We make benefits simple to understand and easy to use. Employees enjoy intuitive tools, clear communication, and a positive experience that builds loyalty and reduces turnover.

⚙️ Scalable for Every Business Size

Whether you’re a 10-person startup or a multi-state enterprise, our systems scale seamlessly — offering transparent pricing, faster setup, and the flexibility to grow with your business.

The Future of Benefits Is Here

The agencies above have set the standard for service and expertise, but the future belongs to firms that combine innovation, transparency, and technology.

Abbott Family Insurance is proud to lead that evolution — helping businesses across the U.S. unlock smarter, more affordable benefits that drive both employee health and financial performance.

Ready to reimagine your employee benefits?

📞 Contact Abbott Family Insurance today to discover how our technology-driven, tax-advantaged programs can help your company stand out — in every state you operate.